Fine Beautiful Info About How To Apply For Service Tax In India

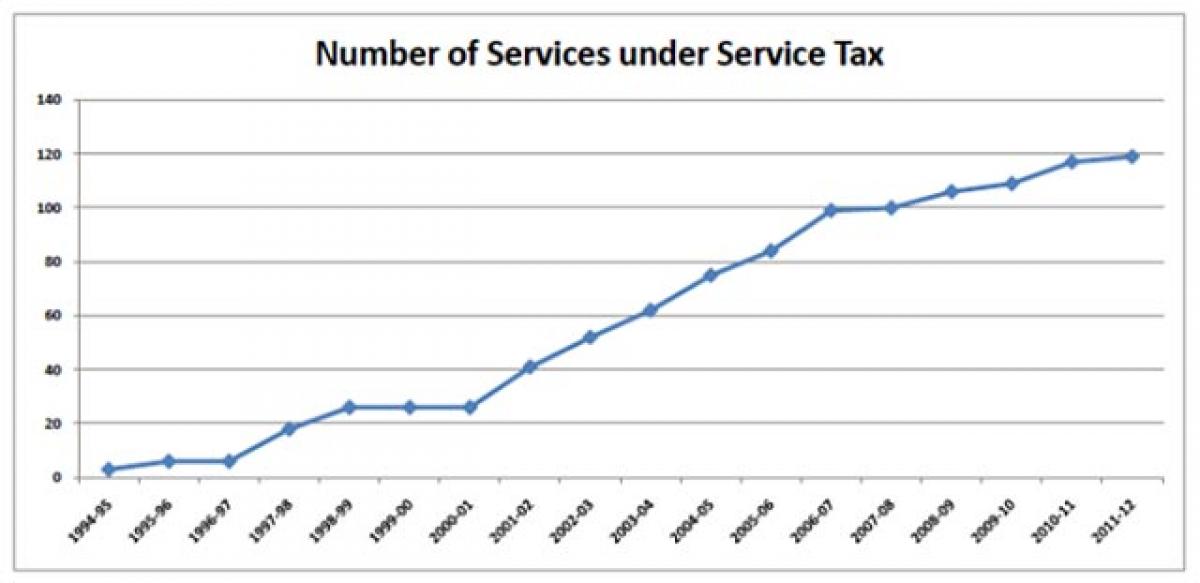

100 services m/o petroleum and natural gas.

How to apply for service tax in india. If the total value of services provided exceeds rs. Go to the official aces website. Track application status track application status track application status;

Visit the official website of aces. In case of goods transport. The following steps will help you register for service tax online:

At the time of submission, users have to. Central board of excise and customs (cbec) is a part of the department of revenue under the ministry of finance, government of india. National government services portal find government services faster.

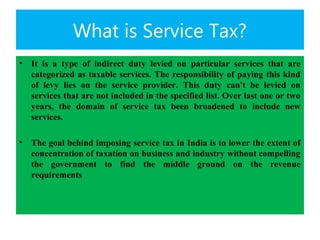

Board resolution authorizing director to apply for service tax registration; Similarly in case a service provider is from outside india, the liability to pay service tax has been shifted to the person receiving service in india. Applying for service tax registration online step 1:

Small scale service providers can avail of service tax exemption up to a maximum of rs 10 lakhs. Documents required for service tax registration india the service tax registration process is not as simple where one needs a set of prescribed proofs and legal forums in order to submit with. It must be filed in the same court where the caveator.

• submit all the required. Listed below are the steps to register for service tax online: Application for withdrawal from composition levy;