Peerless Info About How To Find Out Prior Year Adjusted Gross Income

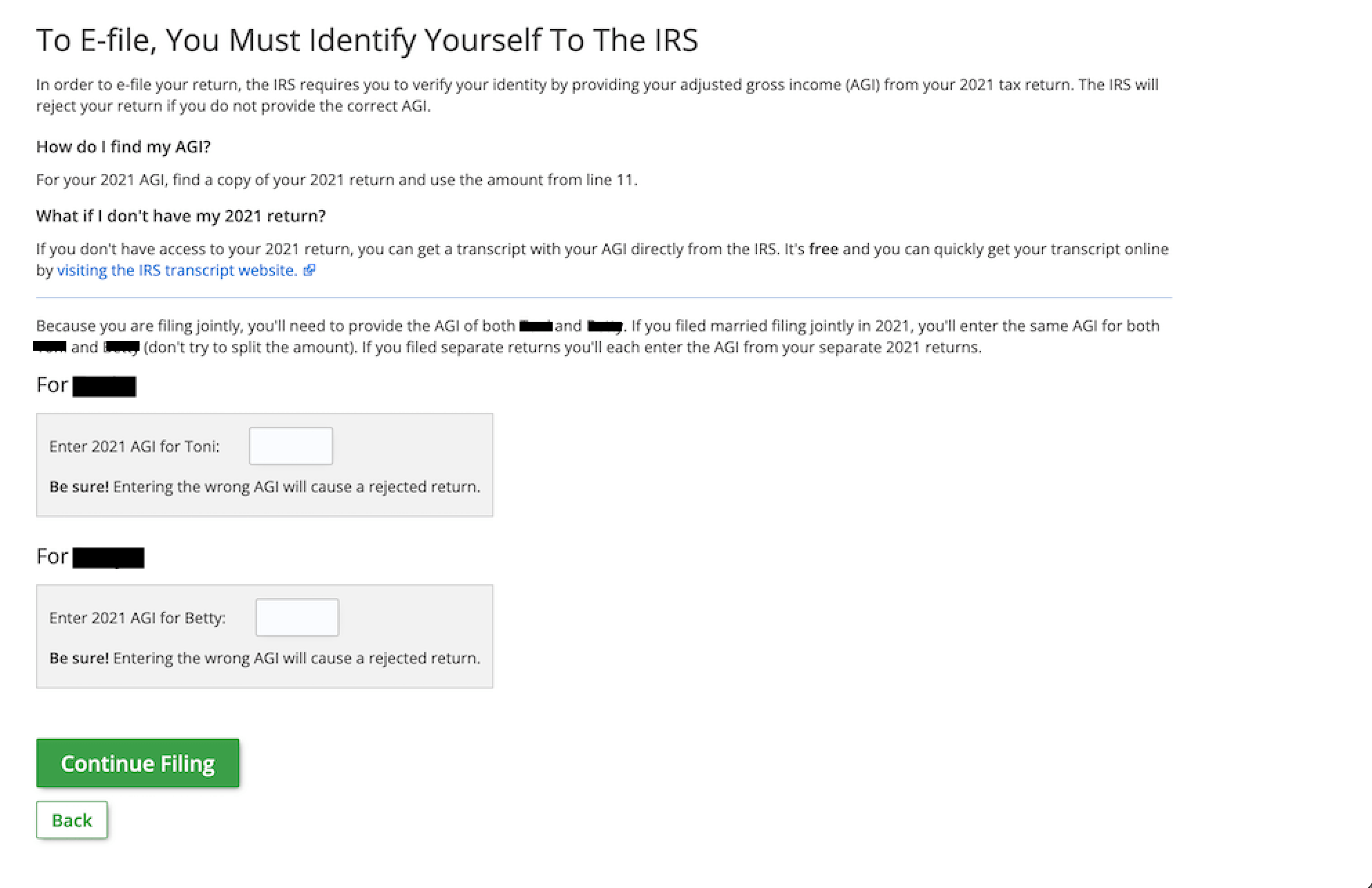

If you’re still waiting for your 2020 tax return to be processed, enter $0 for your prior year’s adjusted gross income (agi) on your 2021 tax return.

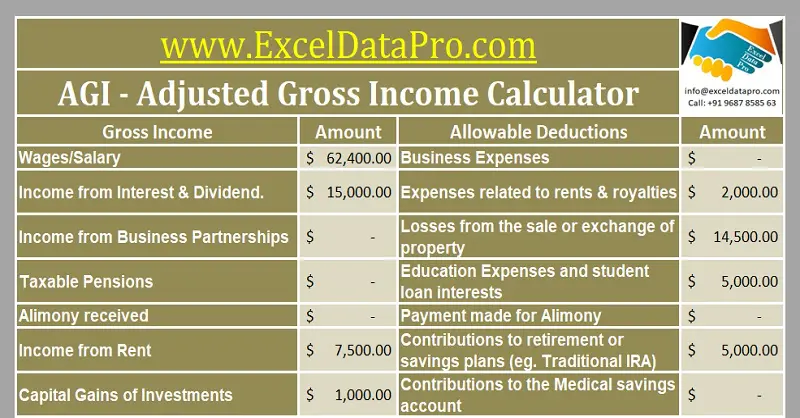

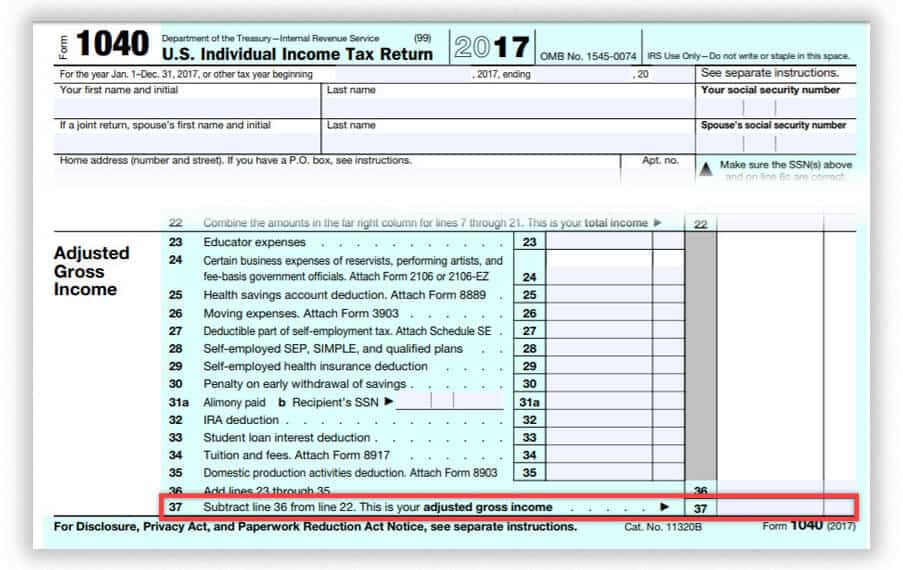

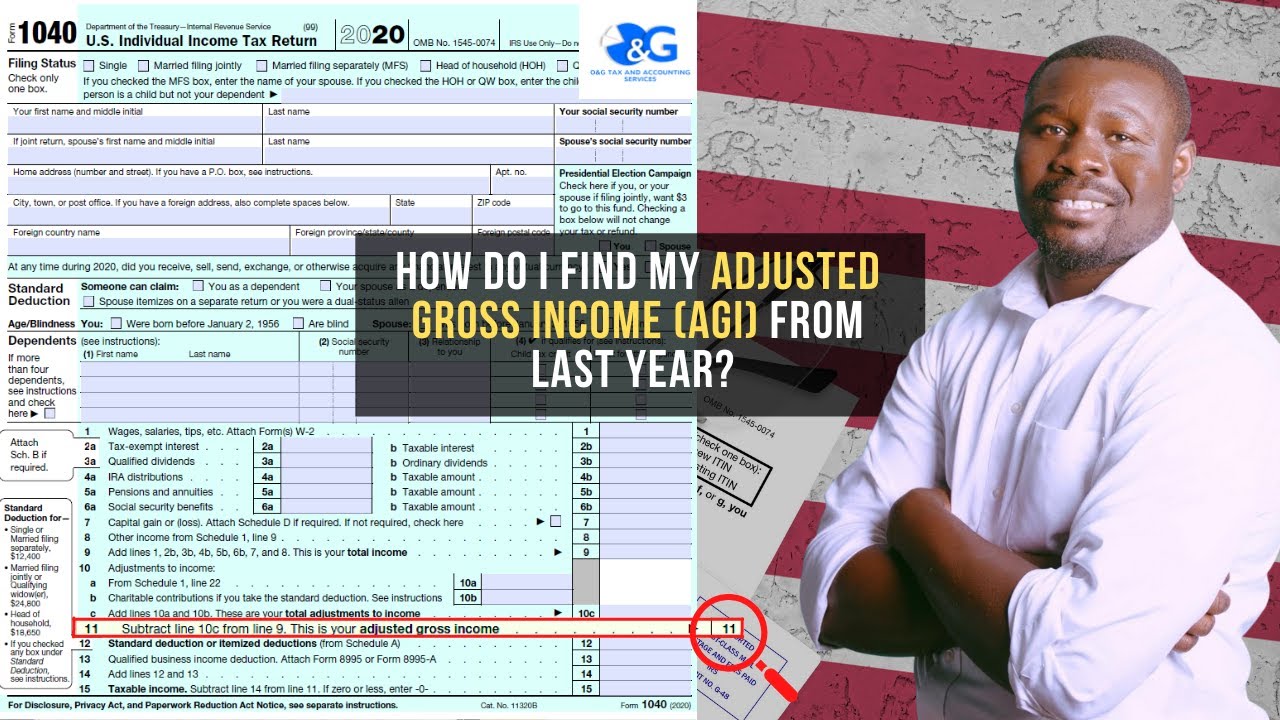

How to find out prior year adjusted gross income. The first step in computing your agi is to determine your income for the. Use the irs’ get transcript online tool to immediately view your agi. No matter the form, you’ll be able to find your adjusted gross income.

You must pass the secure access identity verification process. Did you file your taxes last year? Look for it on your tax.

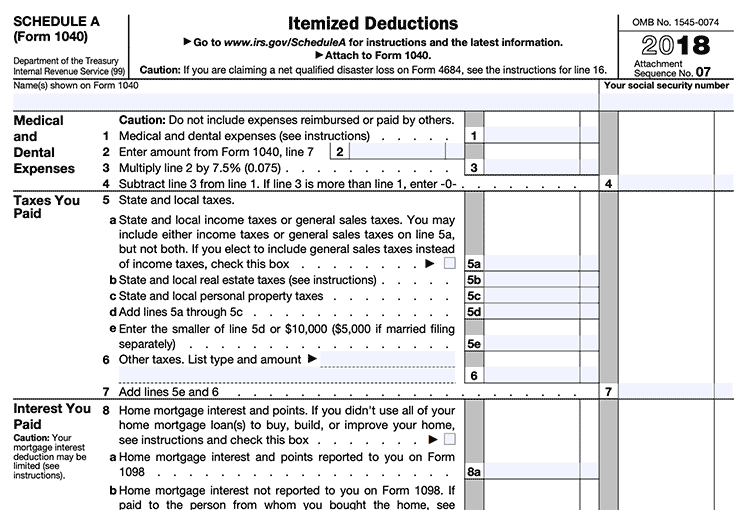

Adjustments to income include such items as. Take a look at the form. Subtract your deductions from your total annual income.

The easiest way to get your previous year agi for the irs is to find your old tax return. How do i find my agi from last year? Where can i find my prior year agi (adjusted gross income)?

Go to www.irs.gov and request a hard copy transcript of your return be mailed to you. Locating last year’s tax return. Here are three ways to locate your 2020 adjusted gross income, agi:

To find your agi from the previous year, you have a few options: Solved • by turbotax • 116317 • updated april 14, 2022. Subtract your total income adjustments from your gross income now that you have determined your total gross income and total qualified income adjustments, put your.

/GettyImages-904286032-4cc94e81854841989b260d5df5ae98d6.jpg)